Podcast

Episode 2: Payment-in-Kind (PIK) Interest Rate Loans

Alex Kensgaard and Chris McCrory, private debt experts at GPFS, delve into the intricacies of PIK interest, loan basics, and the borrower-lender relationship in private debt funds.

Transcript

Alex K: Hello, internet world. Welcome to our second podcast of GP Fund Solutions.

We have myself, Alex Kensgaard, and Chris McCrory back to discuss some more debt specific topics.

For a quick overview for anyone who did not, watch our first podcast, my name is Alex Kensgaard. I'm a Director here at GP Fund Solutions. I've been with the company for a little bit over two years now, and I have 13 years in the fund administration space. I've been focusing mostly on the debt products, the debt investment product type in my career in fund administration.

And, Chris McCrory has also had a ton of debt experience. So Chris, let me hand it over to you and you can talk a little about your background.

Chris M: That's right. I've been working at GPFS for about three and a half years. I've been in the industry fund administration for about 11 years.

My first foray into private equity specifically started in debt. So I've almost exclusively worked on debt funds, within the space.

I'm an Associate Director here at GPFS and I love the combination of investments and accounting. So we're here to talk about another fun topic.

Alex K: All right. Great.

So the plan of action for today, we're going to talk a little bit about what PIK is just in general for a high level overview. We're going to talk about how that fits into some of the loan basics and general investment type products.

And then from some feedback from our first podcast, we wanted to talk a little bit more about some real numbers, some real examples of what the difference between a cash interest rate and a PIK interest rate would mean for actual investment numbers and cash flows. And then from there, we'll talk about a few specific PIK questions that kind of align with that. And then we'll try to connect this to everyone to some examples for everyday life instead of having just talking about private equity investments. So that's our outline for the day. We'll try to cover all these topics in a quick and accurate, timely, manner for everyone. So let's go ahead and jump right in.

Alex K: So the biggest question is what is payment-in-kind or PIK interest? So Chris, do you want to give that a quick off the cuff definition for us?

Chris M: Sure. I think the simplest definition is you're being paid for something that isn't a non-cash variant, and in other examples that are not what we do, it could be even a service or a good as opposed to cash.

In terms of what we are doing, it's actually taking a portion of what would normally be cash payment for interest and converting it into the balance of principal through capitalization at the end of the period, where the payment is occurring.

Alex K: And when you say capitalization too, with the timeline for that one, is that a variable item?

Is that something that's written in those loan documents about when that capitalization is going to take place or if it even would?

Chris M: Yeah. That's a good question. So normally capitalization will occur along the same timing schedule of the cash interest payment.

Most frequently, these are usually monthly. So if you're going to be paying a portion of your interest as cash, at the end of the month, you're usually going to be capitalizing the portion you're not paying at the same time. And at that point in time, it turns into the principal balance for the foregoing future of the loan.

Alex K: Awesome. Thanks for that.

Alex K: And I think we should talk about some of just the loan basics here so everyone can get on the same page with us. So, you know, one of the big differences between an investment in the private equity world is whether you have an equity investment or a debt investment.

So the way I think about that to start is equity is you're having some sort of ownership in that company, in that portfolio company, or you're getting some, you know, common shares as I think is probably the best way to think about it or, preferred stock, any type of ownership or dividends that you're going to be able to receive for this, your investment in this equity position is a pretty wide variety of investment types. Now debt, on the other hand, instead of getting ownership, you're lending that money out. You're going to charge an interest premium that you're going to get returned back.

And at the very end, you're going to get your principal payment back. Now you can have a lot of different terms on these debt investments, just like you can have a lot of different variety in the equity types that exist out there. But we're going to talk about a pretty standard example here in the future where it's just going to be a 30/360, fee accrual type. We'll do some nice round numbers for interest rates, but all of these terms are negotiable, and all of them are written up in the loan agreements there.

So even though we're going to do some straightforward examples, you can definitely get creative in those loan agreements. And we've seen some some pretty interesting ones in our time.

Chris M: Yeah. Just to add to that too, even if a loan does start as a full cash loan, we will sometimes see them amend to include a PIK component sometime down the road during the loan's life. These aren't just a cut and dry and then it's repaid. It's usually a working relationship with the underlying company and the lender to make sure everybody's happy by the end of it.

Alex K: Yeah. And I think that's a really great point too, because that working relationship it does go both ways. You want that portfolio company to succeed.

You want that company to thrive and be able to pay back their debts to specifically to you. All right. Some other loan basic terminology we may cover here.

We have the principal balance. That's basically how much you lent out and what you'll be receiving interest on.

We'll talk a little bit more about the interest rates and terms, the maturity date of the loan. That's going to be how long you want to have that, money out there for. And then when you're expecting to get paid back. And then there's also some additional fees that are going along with this. So I think some of the different type of fee types we see are just closing fees, amendment fees. Anytime that there's some legal work to do on these loans, people do want to get compensated for that.

Chris M: Yeah. And just to expand on that, closing fees are usually the first part of the loan when they're creating it. Oftentimes, it's legal. Amendment fees are if they're changing anything throughout the life of that loan.

It could be at the lender's request. It could be because the borrower can't make their payments. It could be a variety of reasons why they do it. And then I think the other one that we didn't even mention is an exit fee, which is usually coinciding with them leaving the loan position and paying off the full balance.

Alex K: Yeah, we can get into a lot of prepayment penalties and exit strategies we have there, but that may be a podcast for a different day.

Chris M: That's right.

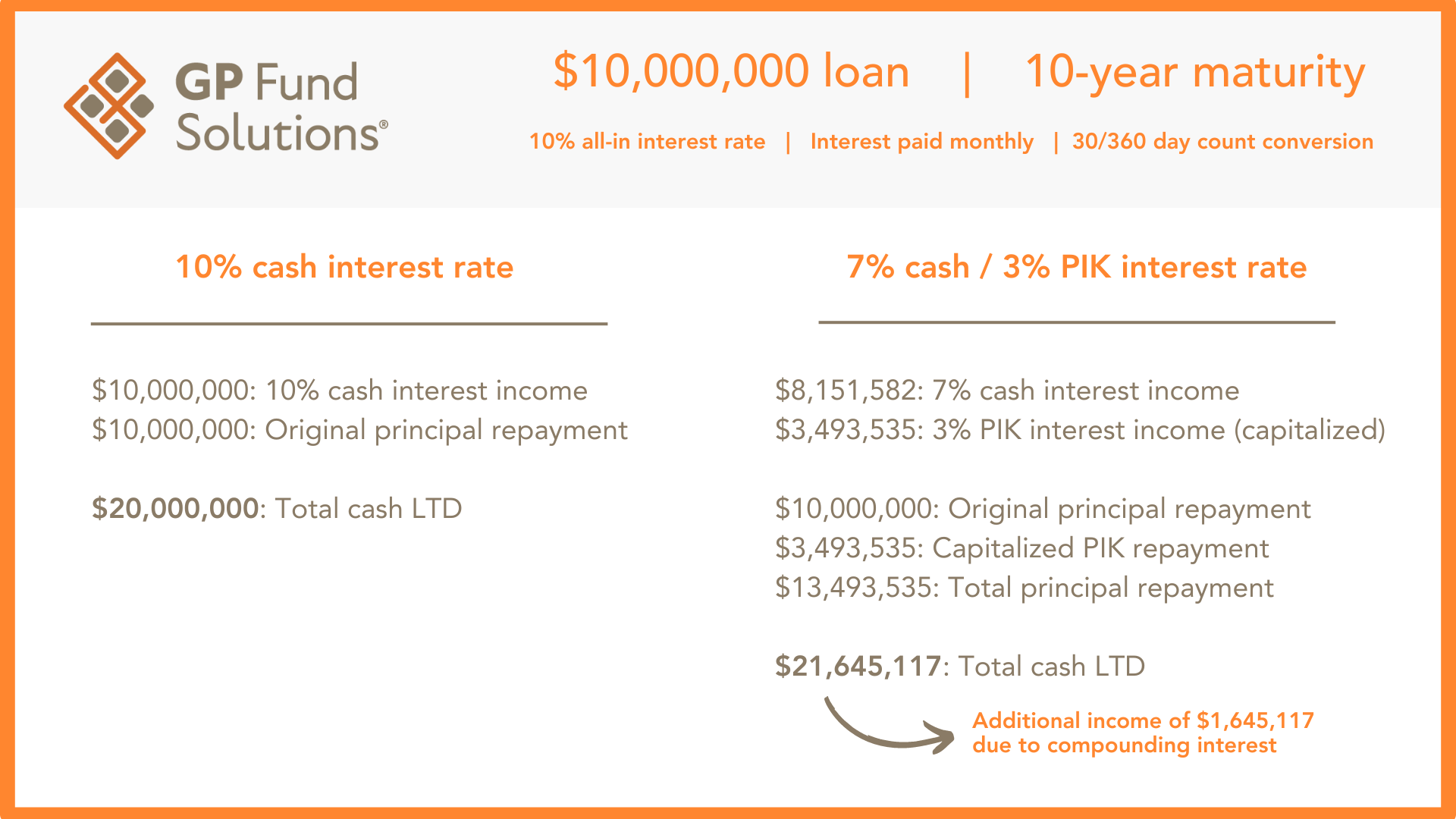

Alex K: Alright. Well, let's start talking numbers here. So let's talk about some real life examples of PIK. So in this example, we're showing some differences between a cash interest only loan, and then we're going to talk about a loan that has a PIK component as well. And both of these are going to have a 10% interest rate, an all in rate of 10%. We're just going to show you one that has it all paid in cash and another one that's going to have a portion of it capitalized and have that compounding interest component. And then we'll see what the differences are after the life of this loan.

So some quick basics here, we're going to do a $10 million loan, 10% cash interest, a 30/360 accrual schedule, and we're going to have a maturity date of 10 years. So in this example for the loan, that's all going to be in cash.

After that 10 year period, you're going to actually earn 10 million dollars of interest. And at the end of that life, let's assume that we're paying off fully at the end with no prepayments during the life cycle, you're going to actually end up with $20 million of cash flows back in. So you lent out $10 million cash. You got that $10 million principal back at the end, but during that life you got paid $10 million of interest for your troubles. So your return there is that $10 million of P and L profit. And then the rest of this is going to be the return of capital there. So that's pretty straightforward.

Still a lot of money, you know, 10% interest rate over 10 years for $10 million. That's real cash. That's real substantial dollar amounts. And that's what we're pretty much seeing in the rate environment now that is a little bit higher because of the prime rate increases. So it's not cheap money anymore. We're not getting, you know, cash interest around that 3-5% anymore. We're seeing something more on the 10% plus range.

Alright. And now for the exciting part of what if 7% was a cash interest rate and you only had 3% being this payment-in-kind interest as capitalizing at, like you said before, the same payment dates as that cash interest piece. So through our calculations here, if you are getting 7% cash interest on a $10 million loan at that 10 year rate, in this new example, you're going to get paid $8 million and around $150,000 of cash interest.

Now that percent PIK interest that is being capitalized, that's going to net you around $3.5 million as well. So the reason why these are different numbers is because you're getting paid less of cash and then you're having that compounding PIK add on to your totals. So overall, once you get your total principal payment at the end, you still have to pay back that $10 million that you lent out, but you're going to also receive that $3.5 million dollars of PIK interest on the backend.

So you're going to get paid a little bit more at the very end. So instead of $10 million of a return of capital at the end of this loan, you're going to get paid, $13 million dollars and almost $500,000 of the payment at the end.

So do you want to talk a little bit about the final cash flow pieces there? So what's the difference there between your total ending cash that you're going to see from a PIK investment versus a cash investment?

Chris M: Sure. In the first example, it's more simple. It's very, very clear the amount of interest you're getting over the life of that loan. And you can model it out from the beginning and know exactly when your payments are and how much you're going to be paying now, in the future, and through the end of the life.

In the capitalization example, the total interest rate is still the same. But the big difference is 3% of the 10%, instead of paying that every single month as cash, you're gonna be rolling that into your principal balance at the end of that period, which will then generate additional interest going forward. So it doesn't seem like it would have that big of an effect. But on a monthly basis over 10 years, it has a pretty big impact.

And we'll get into some of the why and how and why would the lender or the borrower choose to do this later. But essentially over the life of those two examples, the example with the capitalization PIK component will, it'll have about $1.6 million to $1.7 million more of interest, than the first example.

Chris M: So I think that brings up quite a few questions of why. Why would you do that if you're the borrower, for example?

Alex K: Yeah, that's a great way to think about it too. And yeah, there's benefits to the borrower and there's benefits to the lender or as an investment for a private equity firm. So let me pose you this question. If you're the borrower, why would you want that PIK interest component if you're going to have to pay in the end, you know, almost $1.6-$1.7 million of additional interest. That's real cash that's going to have to go out the door eventually.

Chris M: That's right. From the borrower's perspective, it usually comes down to flexibility or need either through liquidity or you want to use the cash that you would normally pay interest for for something else, operationally, maybe it's for some other debt component you have that is worse terms and you want to pay it off earlier. There's a bunch of different reasons. The main reason is usually liquidity. The borrower might not have, a lot of cash on hand on a monthly basis because they've got longer terms on when they receive cash for their business.

So they might want to get that loan now and kind of defer some of that cash payment over time. It can help them grow the business a little bit more. It just gives them a lot more options with what to do with their cash, while still having that leveraged loan to do operations.

Alex K: It's a really good way to think about it is that's a real business that is using this cash for their business needs. And every company is different. Every company may be in a different, you know, stage of their life cycle. If you have a mature company, they probably don't need those startup funds as much where they have those ongoing cash flows coming in for them. But if you're a new startup, you don't have a lot of that cash, and that runway up to, at the front is a little bit different.

Chris M: That's right. The other thing that I've seen in the industry that's pretty common right now is whether or not that capitalization exists on a monthly basis is oftentimes up to the borrower. It's called optional PIK, where they can choose to pay it all as cash, or they can choose to pay up to a certain percentage as this capitalization component, not pay it as cash, put it into the balance of the loan and move on and use the cash for something else.

Alex K: That's a great point right there because the flexibility I think is becoming more and more common. So give someone the option, they can choose what's best for their company at that point in time.

Chris M: That's right. And it kind of goes along with that relationship building.

So, Alex, what do you think on the lender side? What is their reasoning for doing this?

Alex K: It's a great question. I start off with just the potential for higher returns. So even though there's a little bit more risk at getting paid at the very end of a loan, rather than a proportional interest rate every single month or every single quarter, whatever those terms may be, I think the potential for that higher return is what a lot of our investors are chasing after. So you're looking for some of the return aspects that you may get from some of the equity positions where you're looking for a 2x a 3x a 4x and above.

You're probably not going to get as much of that from a debt position. But as we saw from the example before between a cash interest rate of 10% versus a 7% cash and a 3% PIK, that's $1.7 million right there. That's going to be real P and L returns for your fund. And you're still saying that they're predictable as well, because you're still communicating with this company.

You're still understanding that they can make their cash payments on time, but you're just not going to get it all, split out as evenly through those monthly or quarterly payments. It's more of that bullet payment at the end, which is hopefully what you'll get to with, with these loans. And, you know, even in this environment too, we see a lot of these borrowers paying off early as well.

So you're really trying to get together as much of your returns from this investment as quickly as you can before someone wants to pay this off early. And we could talk about, you know, prepayment penalties like we mentioned before, but the whole idea is if you can start compounding early, you're going to get more returns than just that flat cash piece.

Chris M: That's right.

Chris M: I think that probably leads us into our real world examples that are not just private equity debt instruments.

Alex K: Yeah. And I think the one I think about is, you know, the power of compounding interest. And this is something that is taught in schools and it's a pretty interesting concept and it really blows you away when you start to see some visual graphics and charts here. But the power of compound and interest works both for your savings accounts.

Let's say if you have a high yield savings account, that's a really similar concept of you're generating that interest. It's going back to your balance. Then you're earning interest on the interest. That is exactly the same concept in the, in the PIK loan products.

So, you know, the longer the runway there, the longer the timeframe, those numbers can get pretty substantial where the first payment is not where you're really getting that compounding. It's on that last payment where it's a big chunky revenue stream that really gives you that benefit.

Chris M: Yeah. I kind of think about it visually like a snowball rolling down a hill. Just gets a little bit bigger and bigger and bigger. And the longer you do it, the bigger it gets. On the liability side, I tend to think about this as student loans. If you had student loans and for whatever reason you had to defer interest, oftentimes the mechanics of that will compound it or capitalize it, kind of the same concept, into the principal balance, which will cost you more interest down the line the longer you let it sit there and generate interest.

So kind of both sides of the ledger there, you're seeing how this can come into play.

Alex K: And I think that kind of just really relates well to our borrower versus lender mentality. The compounding interest and the snowball effect can work in your favor. It can work against you there.

Chris M: Yeah. I think the key thing here, outside of the numbers is it's built around the relationship between the borrower the lender. And it really is, it's designed to be somewhat flexible, you know, some rigidities to make it safe for both sides, but enough flexibility that both parties can be successful at the end of the agreement.

Alex K: Awesome. Well, thank you so much, Chris. I think, we really dove a little bit deeper into some of the numbers here and some of the real aspects of PIK and compounding interest.

Anything you'd want to leave us with or some wise words, Chris? Not to put you on the spot too much.

Chris M: You are putting me on the spot.

Yeah, I guess pay off your debts and put your money into your assets and use compounding to your benefit. That's I guess what I would learn most about this.

Alex K: Love that. All right, Chris. Well, thank you so much. And until next time, I hope everybody has a great rest of the day or week or month, depending on where we're at in this podcast and and looking forward to the next one.

Chris M: Sounds good. Thanks, Alex. It was a blast.

Alex K: Thanks, all.

Featured on this episode: